The Psychology of Price Takers: How Consumers React to Market Forces

The turbulent market environment causes hyper-competition, which in turn imposes new market rules. Companies are no longer focused on the entire market, but on each consumer, which requires knowledge of psychology. More precisely, the psychology of human behavior and, in turn, psychological pricing strategies. The idea is to reduce consumer stress in a fluctuating market and make high prices attractive.

Understanding the nuances of consumer behavior is crucial because it allows us to tap into the subconscious human mechanisms that make consumers see the value of a good or service even when prices are rising.

Let’s review economic theory and behavioral psychology to see how consumers react to market forces when they feel powerless to regulate prices.

Understanding of Market Forces

Consider the concept of market forces. It includes such things as supply, demand, and external forces.

- Fundamentals of supply and demand

Market prices are mainly determined by supply and demand. When demand exceeds supply, prices rise because the quantity of goods is limited and many people are willing to buy them. Conversely, when supply exceeds demand, prices fall as eCommerce competition for customers intensifies. This balance determines the price fluctuations that consumers face.

- Fundamentals of external market forces

Factors such as inflation, disruptions in global supply chains, government policies, and the state of the global economy also affect prices. Inflation increases overall costs, supply chain problems can lead to shortages and higher prices, while taxes or trade policies can push the cost of goods up or down.

Understanding of Price Takers

Price takers are sellers (manufacturers, farmers, businesses) or individuals (buyers) who cannot control the market price by increasing production or demand.

Consumers are usually forced to accept the market price. However, this situation of acceptance is accompanied by several psychological responses. These include how consumers explain price increases and the need for goods, or what motivates them to forgo expensive purchases. Let’s take a closer look at the psychological aspects.

The Psychology of Price Takers

You know that feeling: you’ve been thinking about buying a new car or sneakers for a few years, but you notice that the prices are going up instead of down. Even after a thorough price analysis to find the best price, you will realize that the price has increased by 20% compared to last year. You’ll either have to pay more or give up on the purchase. If you refuse, you can wave goodbye to your dreams of driving along the ocean in a new car or finishing the London Marathon with an epic running time.

A purchase like this can seem especially coveted, and one that’s hard to pass up if it’s promoted by a respected influencer or one of your favorite bloggers. As you can see, it’s no longer about how much a car or sneakers cost, but about what the consumer gets from owning these things. Trust me, that’s the whole point. Even if market forces don’t work in the consumer’s favor, they (consumers) will still find reasons to make expensive purchases. And that’s the curious part.

Let’s take a look at some of the reasons why this happens.

What matters is the product/service value

Here’s the thing: We don’t buy things; we buy what those things give us, how they highlight our individuality, and what they tell society (and frankly, our neighbors, co-workers, and family members) about us, our status, and our abilities. So value is the name of the game. Meanwhile, a customer-centric business model with value-based pricing at its core proved advantageous for both e-commerce companies and consumers.

We get immediate pleasure from buying expensive things

Buying an expensive item can provide instant satisfaction, especially if it allows us to stand out. We get a quick dopamine boost from shopping, just like when we scroll through social media or eat delicious sugary foods. This can lead to increased confidence and happiness, but these feelings wear off quickly.

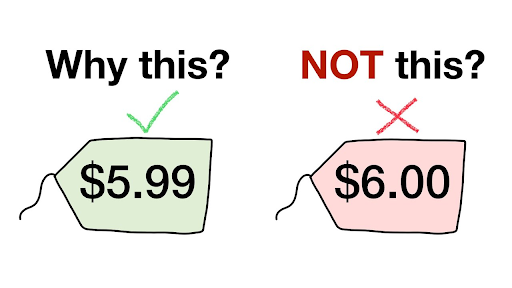

Saving 1 cent makes a difference to us

It may seem too cliché, but $9.99 instead of $10.00 makes a difference. People perceive the first amount as cheaper. By paying $9.99, consumers feel they have beaten the system and made a profit. In other words, even if the price is raised by market forces, consumers will still find a good reason to shop as they did before.

We feel like we deserve more

We all want more than we can afford. If we continue to save money and deny ourselves everything, it is unlikely to increase our self-esteem. And vice versa: as soon as we can afford expensive perfume or a vacation, it signals to our subconscious that we are worth something. The sellers (and the market itself) wisely offered a credit option to prevent people from refusing to buy at a price that was too high for them. Buying an iPhone on credit is no longer so embarrassing when everyone in your neighborhood is doing it. As a result, everyone wins: the seller makes money and the consumer gets the opportunity to tell everyone around them, especially co-workers, the security guard at the business center, and social network subscribers, that they are making good money, which means they are successful and worthy of respect.

How We Buy

To better understand how consumers respond to market forces and to predict customer behavior or demand for your products or services, you can create a CRM system right away. It can help you store and manage a lot of customer information in one place. But first, it doesn’t hurt to learn a few things about how people feel about purchasing in general.

Buying physical goods brings less pleasure

Buying on credit, as mentioned above, is one way to reduce the negative impact of high prices on consumers. If you pay the monthly installments, you won’t feel a significant loss of finances. But you will get something that will elevate you in the eyes of yourself and others.

The problem is that the euphoria of buying a coveted item lasts for 3 weeks, after which the value of the purchase becomes ordinary or even low. This may be due to the cognitive dissonance we experience during this time. After the initial euphoria wears off, we may experience remorse due to cognitive dissonance. This happens when a purchase goes against your values or financial goals, leading to feelings of guilt or anxiety.

Another explanation is a hedonic adaptation, or getting used to the good things we’ve acquired. What we once wanted so badly becomes less exciting. If the consumer is still paying off the loan for the goods, you can expect their psychological state to worsen and their enthusiasm to be replaced by a feeling of being trapped or wasting money. Interestingly, despite this experience, consumers still tend to buy on credit, driven by the desire to own something that will enhance their status.

The danger of expensive, status-driven, physical purchases in unfavorable market conditions is that we tend to compare ourselves to others. This is a dead end because there are so many people in the world who have more expensive cars, sneakers, and watches than we do. The comparison makes us more miserable. Another thing to remember: When you brag about expensive things, it’s a sign of insecurity, and you’re likely to feel embarrassed because there’s always someone to compare yourself to (income level, taste).

Buying experiences is more profitable for both consumers and sellers

Studies have shown that buying experiences bring more happiness than buying material goods. That being said, people around us treat us better when we share our experiences (studies, trips) with them than when we share information about our goods. It’s no wonder that today’s commerce is increasingly focused on experiential goods. In other words, we are not being offered a product to buy, but an experience that we will receive by default. You’re not buying a pair of running shoes, you’re buying an opportunity to become a member of the running culture and tell your classmates, coworkers, and neighbors that you’re a special person.

The memory of an acquired event (a trip, a marathon, a vacation) becomes a special experience, and this experience becomes part of the consumer’s self-concept, which means a lot to each of us. An experiential purchase brings more happiness than the purchase of physical goods. This partly explains why there is such a focus on experiential purchases, even though they are expensive for the consumer.

It is more profitable and useful to talk about your experience (travel) because people perceive you as a more psychologically mature, interesting, cheerful, and kind person. In addition, there is no such thing as the same travel experience, everyone has their own, so it is difficult to compare yourself with others, and therefore less likely to be upset by comparison.

How Consumers React to Market Forces and Market Situation

Earlier, we discussed the general concepts of consumer psychology. Now, let’s look at exactly how consumers might react to the market in a changing landscape where you can’t influence prices.

Consumers fear high prices, so they buy up goods

Consumers react to rising prices with fear and anticipate more price hikes in the future, so they chaotically buy up necessities and fuel. This behavior leads to mass buying, which further increases demand and worsens inflation. It is also important to remember that the pain of losing money (e.g., due to a price increase) is much greater than the pleasure of gaining the same amount of money (e.g., due to discounts or promotions).

Consumers are skeptical about low prices

When something is cheap against rising prices, people doubt the quality of cheap goods. They think they are being cheated or sold expired products. It turns out that high prices have become the new norm for consumers, and anything that deviates from the norm, even if it looks more economically advantageous, is suspect.

People want “because”

It’s long been known that if you want to get ahead in a line at the store, all you have to do is explain to the people in front of you why you need it. People are more likely to let you go ahead when they hear the explanation. It’s the same with prices: when you explain to consumers why prices are going up, it reduces their aggressiveness because they feel valued and respected.

Consumers don’t like being treated unfairly

Companies often intentionally inflate prices when there is an emergency or special circumstance. This can be seen in cities where world-class sporting or musical events are taking place or where there has been a flood or other disaster. Prices for housing, food, and taxi services are rising to unreasonably high levels. If a brand is involved in this kind of injustice, it will hurt its image. So, what we have here is a sense of fairness and injustice.

Consumers get used to prices

People get used to what they encounter over a long period of time. For example, a consumer has been buying a chocolate bar for $1 for a long time, and when the price suddenly rises, it leads to anger and rejection. Consumers compare new prices to what they are used to, regardless of general market conditions or inflation. But consider this: any new price may be the one the consumer will soon get used to.

How Consumers Deal with Market Changes

When something happens in the market that consumers don’t like, they are forced to adapt and apply coping mechanisms. Let’s see how they do it:

- Consumers are cutting back on non-essential items, such as luxuries or restaurants, to save money for essentials. These refusals do not have a significant impact on the usual living standard, but they do allow for better family budget management. By making these changes, consumers can continue to meet their needs without feeling the full burden of rising prices.

- People usually compare prices for the same product from different sellers. In volatile times, customers may spend more time shopping for products as they are forced to rely on price comparisons to find a better deal. For e-commerce businesses, being aware of this consumer behavior can signal a need to monitor prices regularly and thus remain competitive.

- They are looking for cheaper alternatives to products they used to buy at a higher price. It’s a sign of flexibility that allows consumers to maintain their lifestyles while managing their budgets more effectively. Companies can respond to this consumer behavior by expanding their product line to include a lower-cost alternative, or by launching a new marketing campaign that promotes ideas and products that are of greater value to customers.

Each of these behaviors and coping mechanisms helps consumers remain flexible and resilient in the face of changing market forces.