Currency Fluctuations and Their Impact on Pricing Strategy in 2025

The advent of globalization has paved the way for global business operations. Companies work with various stakeholders around the world, doing business with one another and conducting financial transactions.

However, these organizations confront one critical problem—currency fluctuations. How do these impact pricing models and business operations? Keep reading to find out the answer to this crucial question.

Understanding Currency Fluctuations in 2025

In general, currency fluctuations impact the economy. They affect economic growth, commerce, capital flows, and inflation—not to mention pricing, specifically. That’s why companies and organizations should understand these fluctuations. That way, they can set the right pricing models and maintain a consistent cash flow.

By definition, currency fluctuations happen when the value of one currency to another changes frequently. They are usually measured by the exchange rate between two currencies. For example, one U.S. dollar is equivalent to 58.49 Philippine Pesos as of today, which might go up and down the following day.

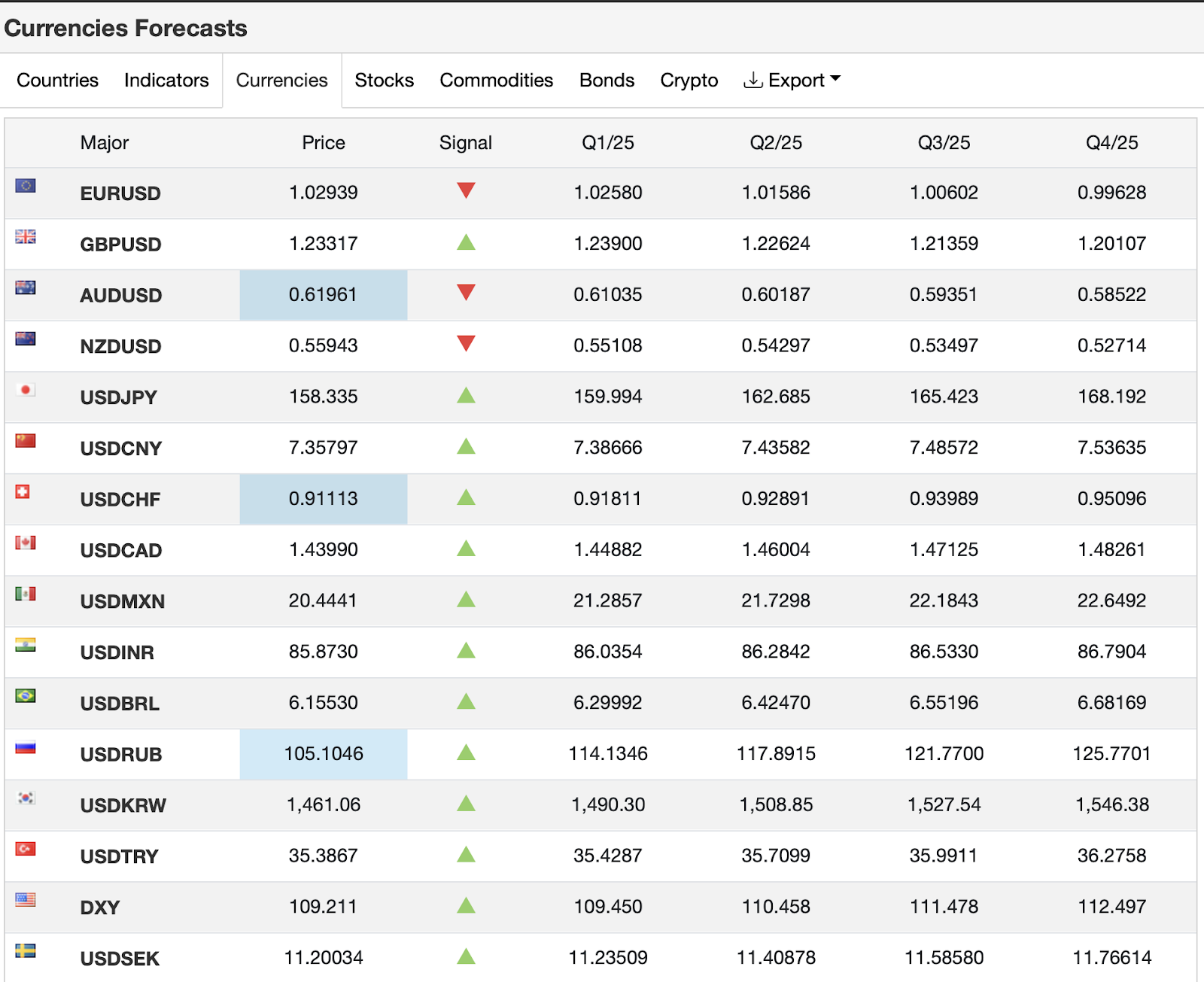

The Trading Economics shows the 2025 currencies forecasts:

The truth is that people don’t pay much attention to exchange rates. Instead, they only take into account their domestic currency, which obviously applies to their day-to-day transactions. However, they consider foreign currencies only on certain occasions, such as global business operations, foreign financial transactions, and international travel.

Business owners operating worldwide and working with global stakeholders should be familiar with foreign currencies. More importantly, they should stay up-to-date with the exchange rates and see how currency fluctuations can impact their business operations. This allows them to set the right pricing tactics without compromising finances.

So, what can you expect in 2025?

Experis Pricing Solutions, an industry leader in pricing strategies, released its 2025 Pricing for Profitable Growth Outlook report. They sought valuable insights from business executives on critical pricing considerations this year. Based on the report, some of the key findings include:

- The influence of inflation on pricing strategies

- The rise of pricing automation amid AI limitations

- The demand for robust pricing models

According to the report, nearly half of U.S. and European manufacturers (46%) have cautious optimism for 2025. They are preparing their pricing models for potential economic growth. Over 25% proactively implement new products or services and employ pricing strategies for this expected growth.

Learn more about the impact of currency fluctuations on pricing strategies below.

How Currency Fluctuations Affect Business Pricing and Operations in 2025

Currencies are pivotal in global business operations, acting as the backbone of international trade and finance. However, currency fluctuations can significantly influence your company’s pricing strategies and business operations.

In a nutshell, currency fluctuations impact three key things:

- Exchange rates and profit margins—how the exchange rate can increase or decrease your income or profits

- Cost of products/services—how the currencies affect the costs of imported raw supplies and finished products

- Customer prices and market positions—how currencies impact the prices of goods and services for target customers

However, currency fluctuations can either deter or contribute to your overall success. That said, here’s how they could affect your business pricing and operations this year:

1. They require a strategic pricing model

There are various pricing structures, such as fixed price (FP), time and materials (T&M), and staffing pricing (SP) models. These models apply based on the business type, size, and even payment methods. You just have to choose what works best for your business.

Unfortunately, currency fluctuations can cause seasonal pricing, which requires you to modify your pricing structure when necessary. For example, if your third-party logistics (3PL) partner experiences currency changes due to geopolitical issues, this might force you to modify your pricing structure.

Expert advice:

Kathryn MacDonell, CEO at Trilby Misso Lawyers, underscores the importance of financial planning and management. She suggests setting a dynamic pricing model, which requires real-time adjustments based on currency movements.

MacDonell says, “Strategic pricing isn’t one-size-fits-all. A dynamic pricing model allows businesses to adapt in real-time, ensuring they remain competitive and profitable, even as currency fluctuations challenge the status quo.”

2. They influence your income and expenses

It’s crucial to understand the global pricing for diverse markets. However, currency fluctuation is one key factor you shouldn’t neglect at all. This can boost or reduce your profits when worldwide customers purchase products from you. Meanwhile, they can also increase or decrease your expenses for working with suppliers, vendors, or service providers.

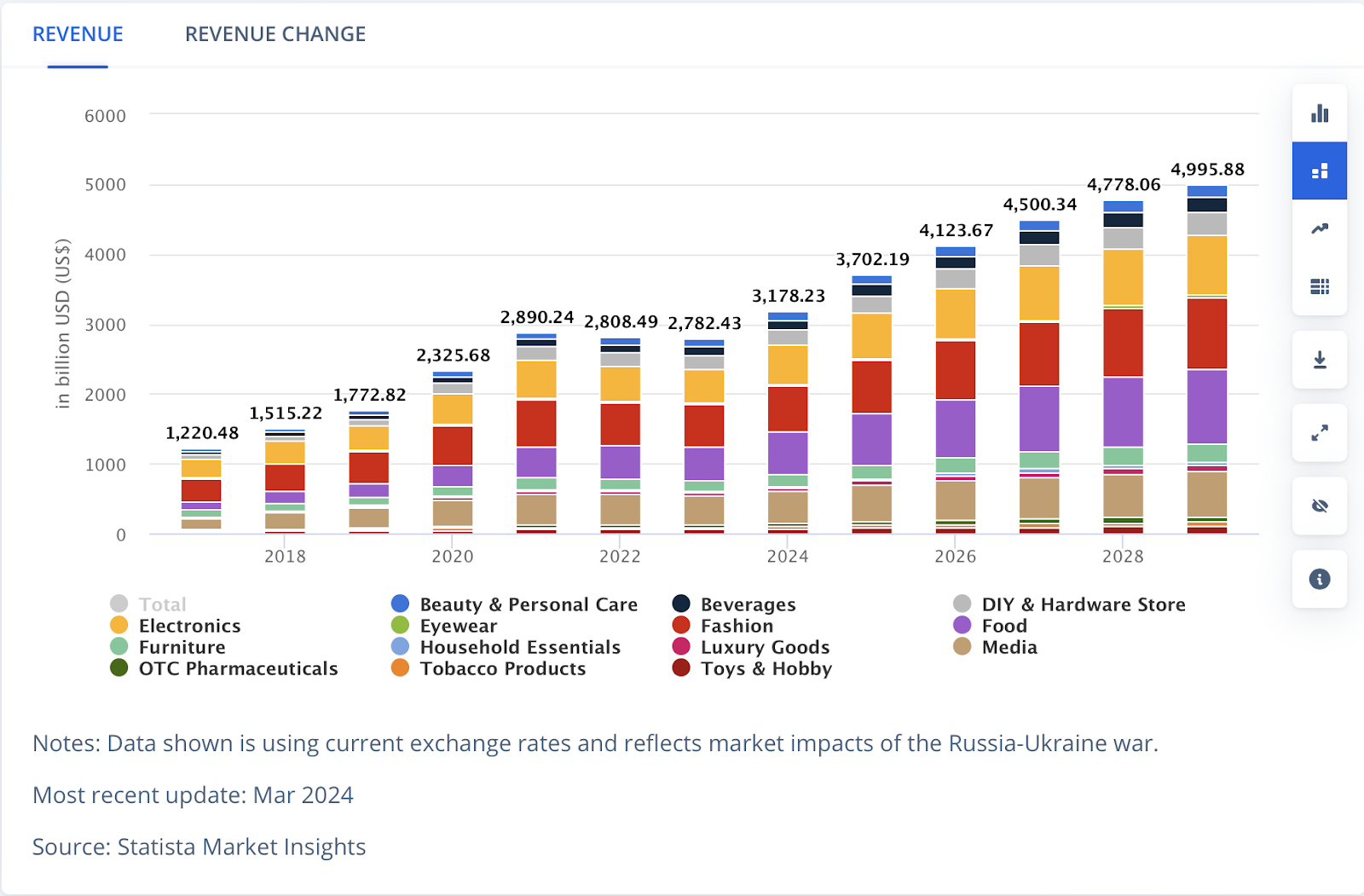

This scenario practically applies to the e-commerce market, amid its growing revenue at 9.47% compound annual growth rate (CAGR). It’s easy to see click-and-order stores catering to a global market. So, currency fluctuations affect how customers patronize your business (income) and how you pay your external vendors (expenses).

Expert advice:

Brooke Webber, Head of Marketing at Ninja Patches, recommends establishing cash flow management to handle currency fluctuations. Despite frequent currency changes, the ultimate goal is to earn more than you spend on your business.

As such, Webber suggests hedging strategies like forward contracts, swaps, and other options. “Currency fluctuations can be a double-edged sword. Hedging strategies are essential for balancing income and expenses in global markets. They are best for protecting your bottom line.”

3. They can cause operational disruptions

Fluctuating currencies can sometimes catch business owners off guard, affecting their pricing strategies. Unfortunately, major price changes can potentially disrupt business operations and negatively affect their bottom line, especially when prospects and customers find your prices unreasonable.

Mitigating risks for operational continuity in e-commerce or retail is crucial. For instance, you can make currency forecasts, establish flexible pricing, or set aside emergency funds to cover financial shortcomings. That way, you’ll be prepared for potential currency fluctuations and pricing changes.

Expert advice:

Max Tang, CMO at GEEKOM, suggests setting contingency funds in place. He believes this is imperative should operational disruptions due to major currency fluctuations occur. “Operational stability starts with proper planning and preparation.”

Tang shares, “Establishing contingency funds is critical for navigating disruptions caused by major currency fluctuations, ensuring your business remains resilient and operationally sound.”

4. They make or break global partnerships

Currency fluctuations can affect the costs of working with global stakeholders. They might compel you to continue or stop your partnerships with third-party service providers or external vendors. Take your supply chain strategies as a perfect example of how currencies make or break partnerships.

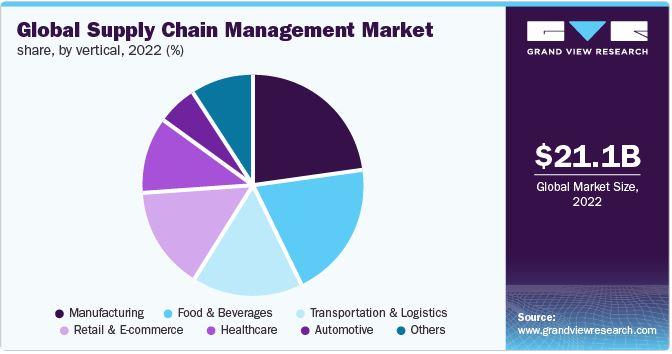

Suppose your South American supplier increases its material cost due to an unstable currency. In that case, you might eventually switch to an Asian supplier with a more stable currency and lower cost. In fact, several businesses invest in supply chain management, resulting in substantial growth from $21.1 billion in 2022 to $48.59 billion by 2030.

Expert advice:

Chris Aubeeluck, Head of Sales and Marketing at Osbornes Law, suggests diversifying stakeholder partnerships. However, he emphasizes the need for contract agreements with suppliers, couriers, or other service providers.

Aubeeluck argues, “Diversifying stakeholders is key, but solid contract agreements ensure stability and protect your business from abrupt cost changes driven by volatile currencies. Ultimately, currency fluctuations can redefine your global partnerships.”

5. They affect customer support and loyalty

There’s no denying the importance of pricing for businesses and consumers. However, frequent currency changes can make your prices volatile. This can drive potential customers away and even compromise customer retention, decreasing your bottom line.

Take this research study on how dynamic pricing helps businesses adjust prices based on market conditions. This study looks at how exchange rates affect package tour prices. It reveals that prices rise with high demand or clearance sales but drop for advance bookings. Clearly, currency fluctuations and pricing strategies impact customer support and loyalty and white-label support solutions.

Expert advice:

Heed our advice: Combat currency changes and establish consistent pricing. Take it from Murtaza Oklu, Owner of OMO Transfer. The company always considers its global customers when setting prices amid currency fluctuations.

Oklu suggests leveraging digital tools and technologies. “Consistency in pricing builds trust. Using AI and predictive analytics helps stabilize pricing amid currency fluctuations. This ensures your customers feel valued and remain loyal to your company.”

6. They determine business growth and expansion

It’s crystal clear: Currency fluctuations impact pricing strategies and business operations. Poor pricing strategies easily swayed by currency changes can lead to bankruptcy and even shutdown. Meanwhile, pricing models that weather fluctuations contribute to growth and expansion.

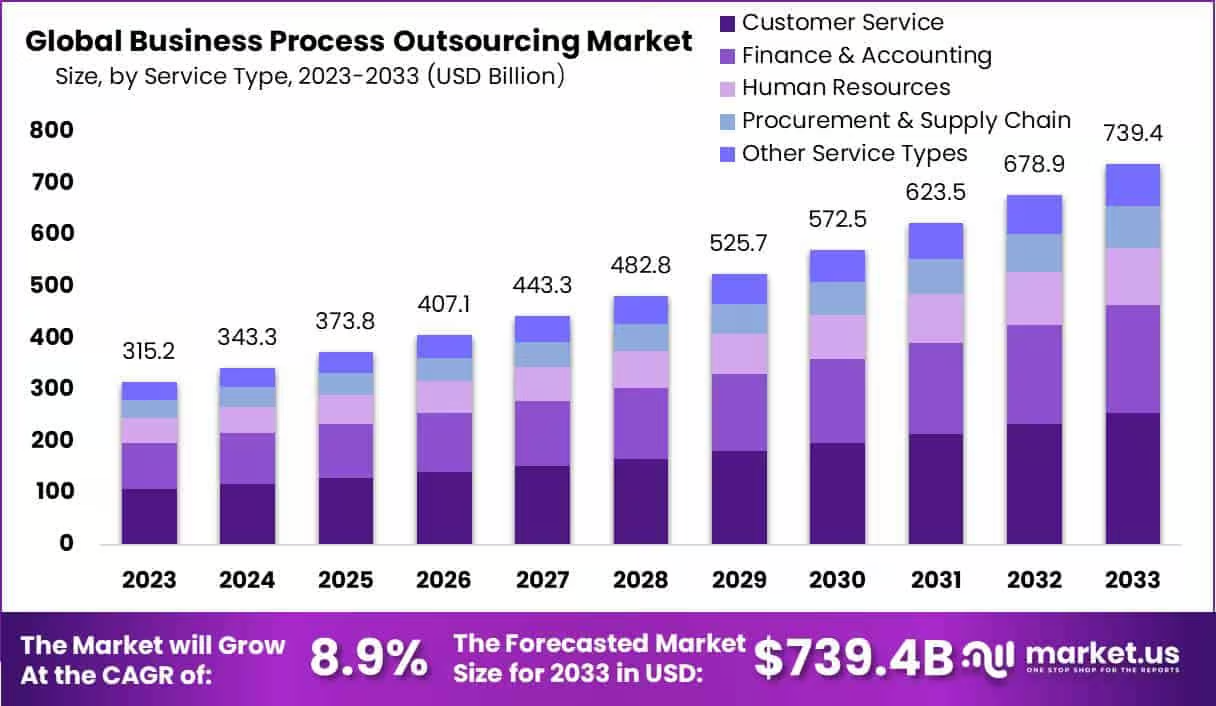

With the right pricing model, you can venture into new market penetration for business expansion, mergers and acquisitions (M&A), and outsourcing/offshoring in another country. In fact, the global BPO market shows no signs of slowing down, expanding at an 8.9% CAGR.

Expert advice:

It is crucial to stay abreast of currency changes and adjust your pricing tactics. Learn from Jonathan Feniak, General Counsel at LLC Attorney, who recommended adding a transparent, clear pricing structure to your contract agreement.

Feniak shares, “Growth hinges on adaptability. Staying updated on currency fluctuations and aligning pricing strategies accordingly enables businesses to seize expansion opportunities while mitigating financial risks.”

Final Words

Currency fluctuations significantly impact global business operations. They affect pricing models by influencing customer prices, product/service costs, and profit margins. Consider the expert advice shared by business leaders above, and you can rise above these currency fluctuations for business growth and success!

Do you need help with your pricing strategies amid currency fluctuations? Price2Spy offers an all-in-one solution for price setting, monitoring, and optimization. What are you waiting for? Sign up now for a free trial!