Price Sensitivity: All You Should Know

How do you set a price for your products? Deciding on what to charge for a product or a service is a step that many CEOs and online retailers don’t take seriously enough. Instead of taking a few different factors and a lot of data into consideration, they simply rely on their experience and senses when they set the price.

If you are one of them, you might be losing a considerable amount of profit right now, because the price plays an important role in the decision-making process for many customers. But how important is it? It depends from one case to another, and this is where the price sensitivity comes into the spotlight.

What is price sensitivity?

Price sensitivity is the degree to which the product or service price affects consumers’ purchasing behavior. In other words, it is a measure of the demand change in the case of the price change.

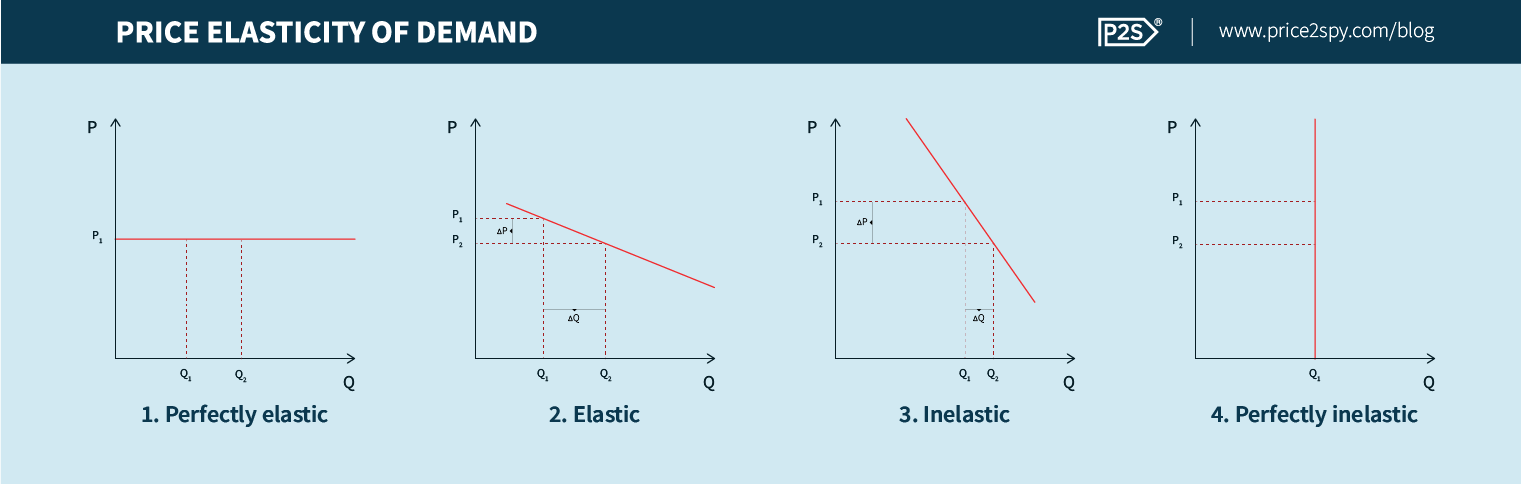

Price sensitivity is directly related to the elasticity of demand. According to the law of demand, if all other factors remain constant (ceteris paribus) – an increase in price leads to a decrease in demand.

If the product elasticity is high, a small price increase will drastically decrease the demand, and if the product is inelastic, the price change won’t significantly affect the demand. This means that usually, there is a high price sensitivity for the elastic products and a low price sensitivity for the inelastic ones.

For example, the demand for gas is rather inelastic, so if the price gets a little higher, most of the customers will continue buying it, since they are dependent on it. This means that the price sensitivity is low for gas.

However, you should be aware that there are a lot of factors that affect the purchasing decision. So, if only one gas station raises the price and there is another station in the area, the chances are that it is going to lose some customers although gas is an inelastic good in general.

Why is price sensitivity important?

If you keep track of price sensitivity, you will be able to understand the impact of a price change on your profits. Furthermore, it will help you with the timing of a price change, since you will better understand the current mood among the customers. Since the price sensitivity is not fixed and constant and depends on multiple factors, keeping track of it will help you always pick the right price.

It will also help you get as close as possible to the equilibrium price. This is the point where supply and demand produce the most revenue possible.

Factors affecting price sensitivity

As we already mentioned, the price sensitivity is related to the elasticity of your product. This means that it depends on the industry you are in. Salt is usually a less elastic product than a sports car. This means that even the most price-sensitive consumers will continue buying salt if you raise the price, but the demand for a certain sports car will drop if the price goes too high.

However, it’s not only the industry that affects the product’s pierce sensitivity. The sports car we mentioned above can still get good revenue if the following factors are in its favor.

- The reference price – customers always compare prices of similar products. The bigger the difference between your product’s price and the reference price, the higher the price sensitivity. This can be avoided in two ways. First, you can resort to a competitive pricing strategy, and keep your prices similar to your competitors. The other way is price anchoring. It relies on the fact that the reference price for your products is another one of your products on many occasions. Let’s say you are selling vacuum cleaners. The price of the new models is $250, and the most obvious reference would be the earlier model, so if you keep that model’s price high (at around $220 for example), the difference between prices will be smaller than if you decided to reduce the older model’s price to $190, and therefore the price sensitivity will be reduced.

- The ease of comparison – this one is related to the previous factor. It’s not easy to have the reference price if the product is hard to compare to any other alternatives. Some premium and luxury products are very hard to compare, so the customers’ price sensitivity will be lower. Of course, you cannot make your product premium, if it’s not in its nature, but you can invest in some marketing a branding, to differentiate it from the alternatives and make it more recognizable.

- Switching cost – consumers are usually less price-sensitive for something they already subscribed for or paid for the set-up since they will have to spend additional money if they decide to switch that product or service. For example, if someone already paid the annual ticket for the bus ride, and you raise the price of the snacks you are offering on that ride, they will most likely continue buying those snacks. Also, if a person already paid for an optical internet set-up in one company, they will be less likely to go to another internet provider if the monthly price rises by a few percent.

How to measure price sensitivity?

To make things clear, we make a difference between calculating and measuring price sensitivity. The first one is based on a formula and gives us a number as a result, the second one has a more empirical value and provides us with more useful information.

Calculating price sensitivity

The formula for calculating the price sensitivity is quite simple.

% Change in Quantity / % Change in Price.

For example, a company increased the price by 40%, and the purchases fell by 30%. Using the formula, we can calculate the price sensitivity:

Price Sensitivity: - 30% / 40% = - 0.75

So we can say that for every percentage with which the price increases, it affects the purchase by ¾ of a percentage. This means that the product is very price-sensitive.

To do this calculation, you will need to already have some data, and this would mean that your revenue is already affected by the price change you performed on that highly price-sensitive product. So, how to avoid this? The answer lies in the techniques that allow you to measure the price sensitivity instead of calculating it.

Free 14-day trial!

Start your Price2Spy trial now, and see how it can ease the process of implementing your pricing strategy.

Try for freeMeasuring price sensitivity

Van Westendorp’s Price Sensitivity Meter

This is a set of questions that gives you the chance to gauge price sensitivity from real customers and get an understanding of how much are they willing to pay for a product. This method is great because it gives you information before the product is even launched.

Direct probing

The consumer is enquired about the lowest and the highest price he is willing to pay for the product or service. This allows you to have the lower and the upper limits of the consumers.

Price laddering

In price laddering, the consumer is asked to rank purchase intention at a given price from 1 to 10.

Sequential preferences

Here, the respondents are asked to pick a brand when the two brands have the same price. Then by keeping the price of one brand, the price of the other is altered, looking for the consumers’ reaction.

Tips to reduce price sensitivity

When a brand or a retailer wants to reduce price sensitivity, the first idea that usually comes to mind is simply lowering the price. Yet this is not completely true. If you want to reduce price sensitivity, the much better way to go is by trying to sell value to price-sensitive consumers. Here are a few tips on how to achieve your goal:

- Marketing (show that your product is better) – customers will always pay attention to the price. However, for many customers, the quality of a product is a very important factor as well. Now, you may know that your product has some great qualities, but how would they know? That’s right – advertise and try to explain why your product is worth the money.

- Branding – price sensitivity usually falls when a brand gets stronger. For almost every product on the market, there are a lot of different alternatives, but would people want to switch? The answer is NO. If you create a strong and recognizable brand, people will tend to make their decision-making process easier, by sticking to your brand, instead of wasting time on trying new things.

- Unique experience – try to make your relationship with a client more personal. Give them some special offers and personalized promotions, try to understand their needs, and answer their questions.

- Price skimming – this will not directly lower the price sensitivity, but price skimming can help you first collect revenue from the customers who don’t mind about the price and then broaden your reach to more price-sensitive customers by lowering the price.

The tips we provided might not always be helpful, but with a carefully designed pricing strategy and following some of the advice we provided, you can expect at least some reduction in the price sensitivity.

Invest in price sensitivity analysis

The whole process of pricing requires a careful approach. If it is done right, it will be the single most important propeller of your revenue. This is why it is important to get it done before you go to market.

Always invest in price sensitivity analysis, and research your market and your competitors. By analyzing consumer reactions to price adjustments, companies can identify the optimal price point that balances profitability and market competitiveness. This analysis enables businesses to make informed decisions on pricing structures, discounts, and promotions, ensuring that they align with consumer expectations and market conditions.

For this purpose, a price monitoring tool such as Price2Spy could be of great help. Also, since price sensitivity is not a fixed thing, and it changes depending on a lot of factors, a well-designed, automated solution for repricing becomes more and more inevitable every day.

Try Price2Spy for free and see how it can make your workflow faster and improve your profits in just a couple of weeks.