An Ultimate Guide to Cost-Based Pricing 2025

Imagine you’re opening a small bakery. You’ve got flour, sugar, eggs, and other ingredients to buy. You also have to pay for rent, electricity, and your hardworking team. How do you figure out how much to charge for a cupcake? That’s where cost-based pricing comes in.

In simple terms, cost-based pricing is a way of setting your price by adding up all your costs and then adding a little extra on top—your profit. It’s one of the oldest and most straightforward ways to price anything.

But why does this matter in 2025? Think about how prices for everything — groceries, energy, even coffee — have been changing a lot lately.

Annual inflation in the US has risen from 3.2% in 2011 to 8.3% in 2022.

As businesses, big and small, look for ways to stay steady, understanding and using cost-based pricing well could make a big difference.

What’s next? Let’s see why cost-based pricing works and how you can use it to your advantage this year!

What Are Core Cost Components?

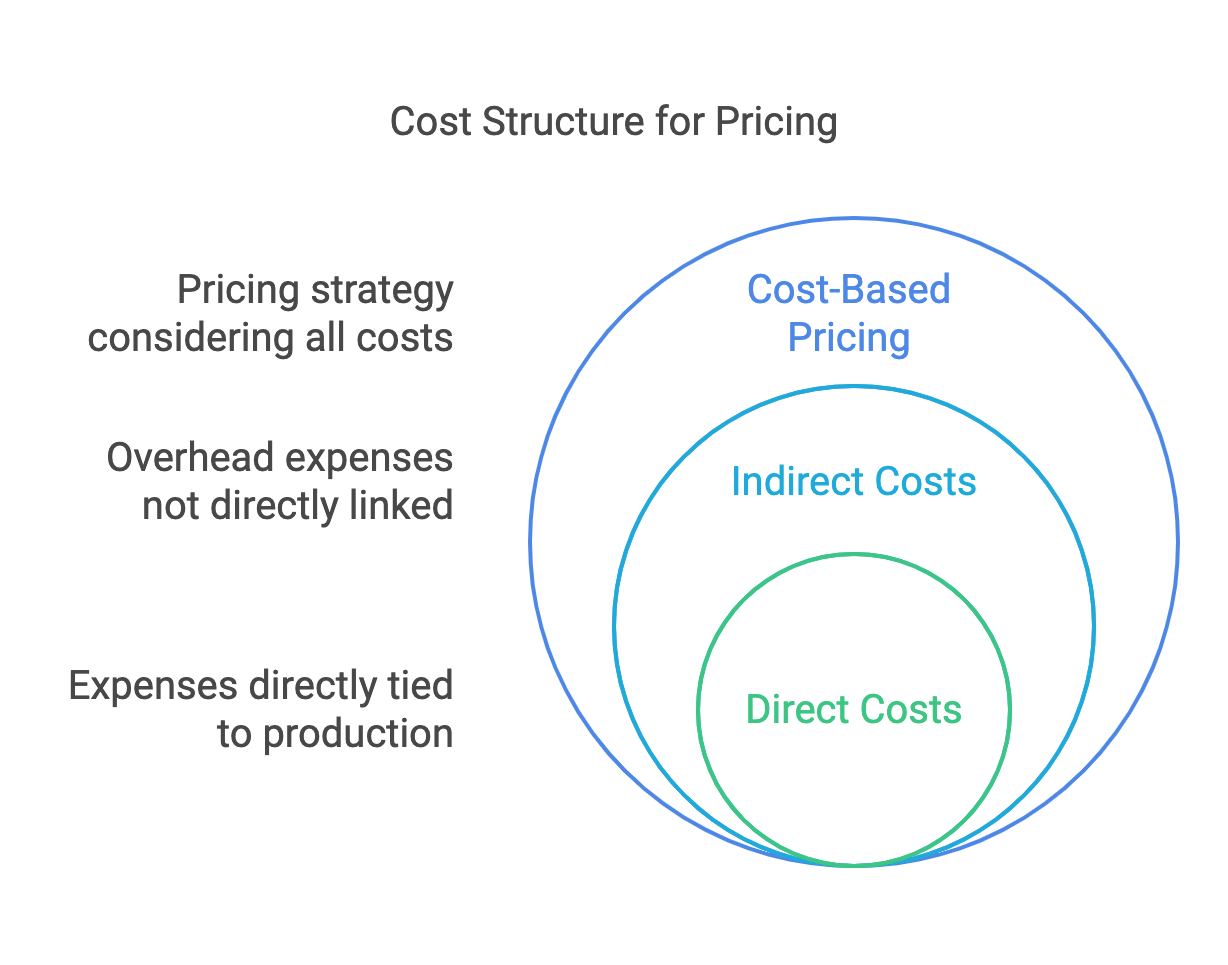

To get the most out of cost-based pricing, you need to understand what goes into your costs. There are two main types of costs: direct and indirect.

Direct Costs

Direct costs are the ones you can point to right away. They’re directly tied to creating your product or service.

- Raw materials and labor

Take Detectico as an example. They see their advanced algorithms, secure databases and global network connections as the “raw materials” of their service. These are what power their precise location detection. The tech team behind it? They check that every search runs smoothly – their skills and expertise are the “direct labour” of Detectico. - Manufacturing overhead

These are costs you need to make your product but aren’t as obvious as raw materials. This includes server hosting, cybersecurity protocols, and user interface tools that make location detection private, secure, and easy to use. - Production equipment

Your platform couldn’t operate without its “equipment.” In Detectico’s case, this includes the advanced APIs and database integrations, as well as the costs of maintaining or upgrading these systems.

Indirect Costs

Indirect costs are a bit trickier. They don’t go directly into making your product but still play a role in your business.

- Administrative expenses

These are the behind-the-scenes costs, like salaries for your office staff or the software you use to track orders and inventory. - Marketing and sales

How do people find out about Detectico? Targeted digital ads, social media campaigns, or email newsletters. These costs are indirect but crucial for attracting and retaining users. - Facility costs

These costs cover things like office space for the team, utilities like electricity and internet, and data center costs. This makes the service reliable and ensures there are no outages.

Calculating Your Price

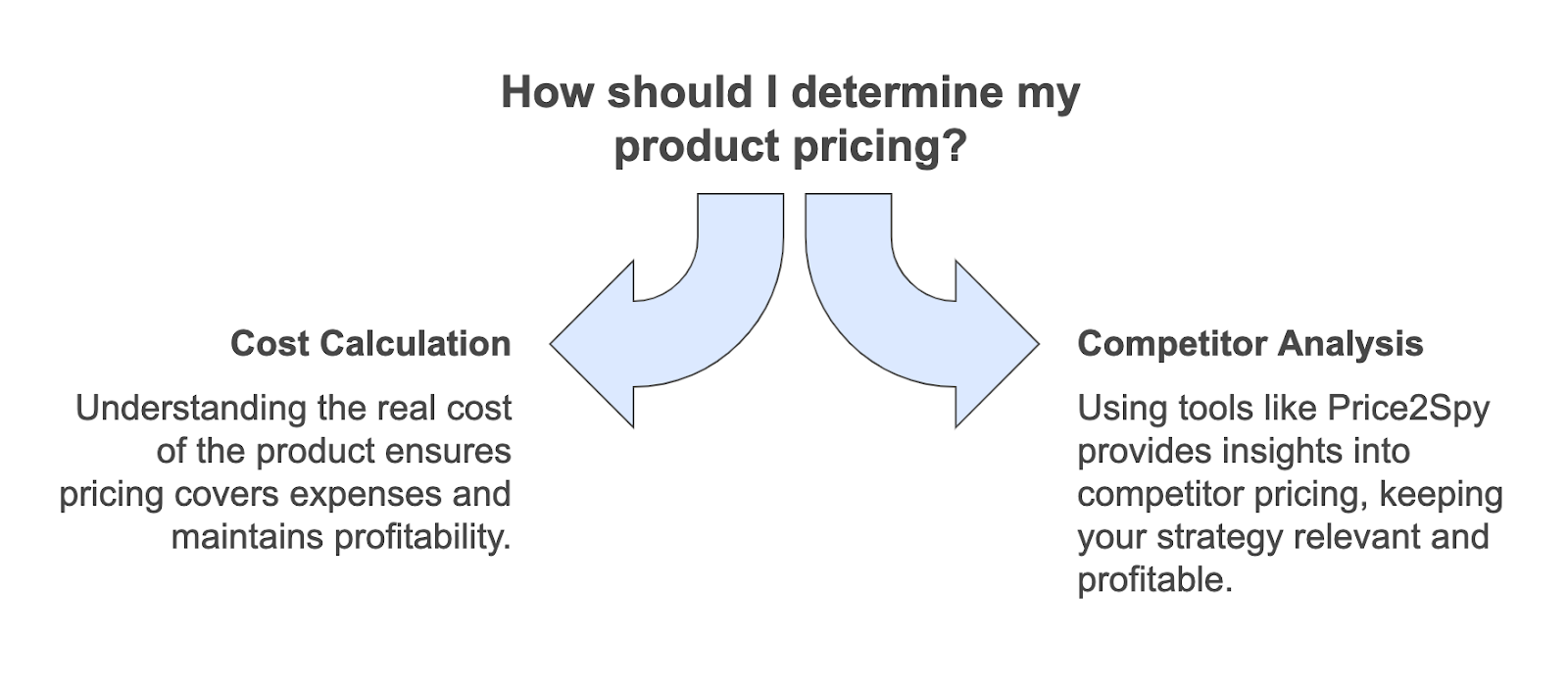

Before you set your price tag, you need to know the real cost of what you’re selling. We recommend combining your calculation with other methods. For example, tools like Price2Spy offer real-time insights into competitor pricing. So you’ll know if your pricing strategy remains relevant and profitable.

Basic Formula

Cost-based pricing starts with a simple equation:

Total costs + Markup = Selling price

Here’s how it works:

- Add up all your direct and indirect costs. This gives you the total cost of making your product or providing your service.

- Decide on a markup. This is the extra percentage or fixed amount you add on top to make a profit.

For example, if your total cost to provide a phone location service with Detectico is $5 and you add a 50% markup, your selling price becomes $7.50.

Industry-standard markup ranges

Markups can vary depending on the industry. Restaurants might use a 300% markup to cover costs, while tech companies might stick to 20-30%. The key is finding a balance between covering your costs and staying competitive.

Break-even analysis

Before setting your price, it’s a good idea to calculate your break-even point. This is where your sales just cover your costs — no profit, no loss. Knowing this number can help you decide if your markup is realistic or if you need to adjust it.

Modern Considerations

In 2025, businesses have access to tools and strategies that make cost-based pricing smarter and more flexible.

Digital tool integration

Gone are the days of manually crunching numbers. Tools like pricing software or spreadsheets with built-in formulas can save time and reduce errors. These tools can also offer insights into trends, helping you stay ahead.

Real-time cost tracking

Prices for materials and other expenses can change quickly. Keeping track of these shifts in real time helps you adjust your prices when needed, ensuring you don’t accidentally lose money.

Market-based adjustments

While cost-based pricing starts with your costs, you can’t ignore the market. In a competitive environment, knowing what others charge for similar products or services lets you tweak your prices without losing your edge.

Implementation Strategy

Cost-based pricing sounds simple, but putting it into action takes planning. Here’s a guide to help you get started without missing a beat.

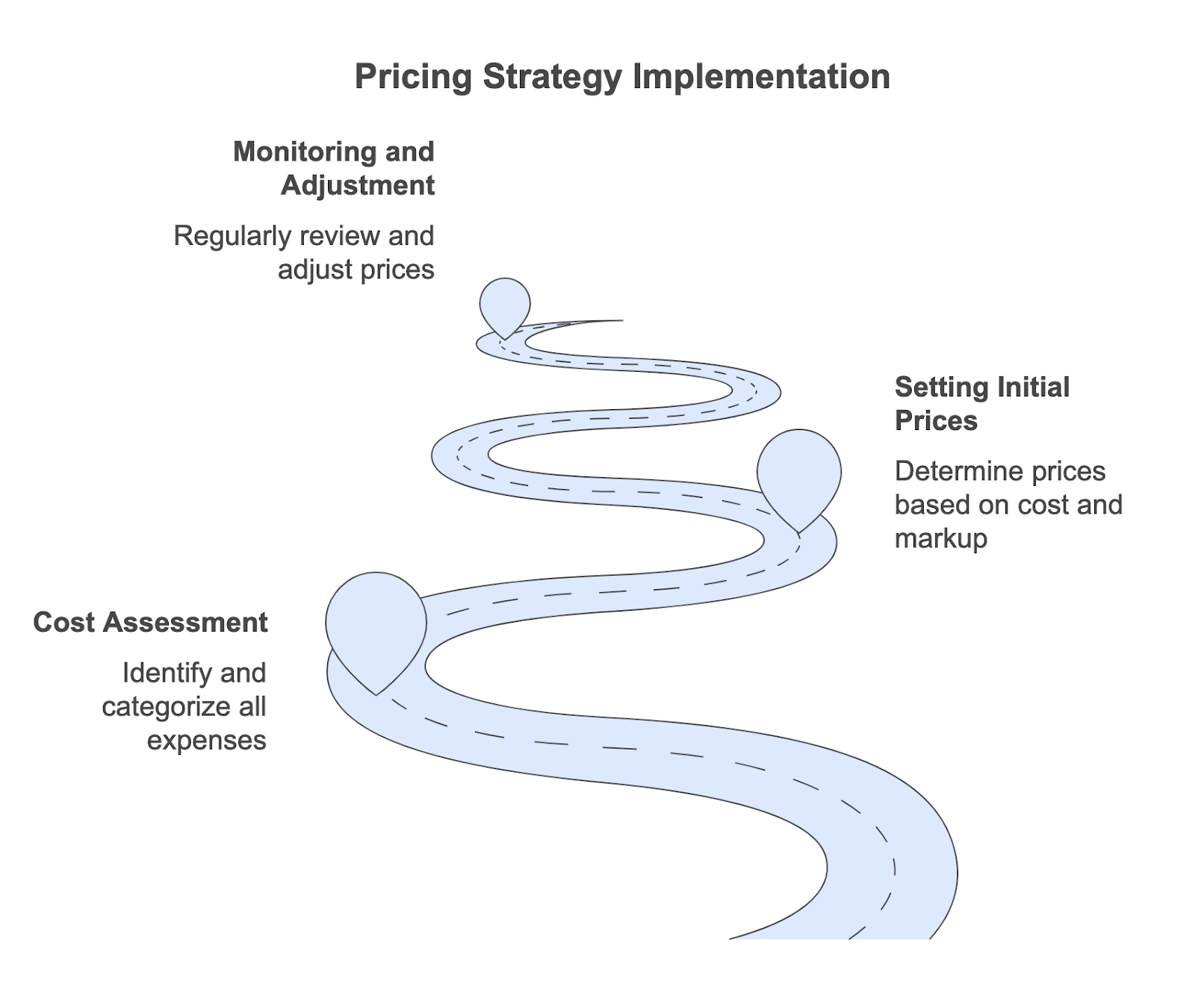

Step-by-Step Process

- Cost assessment methods

Start by digging into all your expenses. Separate direct and indirect costs, and don’t forget small ones like packaging or software subscriptions—they add up! Use tools or spreadsheets to organize and calculate your total costs. - Setting initial prices

Once you have your total costs, decide on a markup that fits your business goals. For example, are you looking for steady growth, or do you want to compete on price? Use your break-even analysis as a checkpoint to make sure your prices cover your expenses. - Monitoring and adjustment

Prices aren’t set in stone. Review your costs regularly—every quarter, or whenever significant changes happen. If raw materials get more expensive or customer demand shifts, adjust your prices to stay profitable.

Common Pitfalls to Avoid

Even with the best strategy, mistakes can happen. Here are a few to watch out for:

- Hidden cost oversight

It’s easy to forget less obvious costs, like maintenance or employee training. Missing these can leave you underpricing and eating into your profits. - Market misalignment

If your price is far higher or lower than your competitors, it can send the wrong message. A price that’s too high might scare customers away, while one that’s too low could make them doubt your quality. - Inflexible structures

Sticking rigidly to your original formula can hurt your business in a fast-changing world. Stay open to tweaking your prices based on new data or market conditions.

Conclusion

Cost-based pricing might seem like a straightforward method, but in 2025, it’s more powerful than ever when done right. By understanding your costs, setting thoughtful markups, and staying flexible, you can create prices that keep your business running smoothly and profitably.

Remember, this isn’t just about covering expenses—it’s about knowing your worth and confidently sharing it with your customers. Whether you’re selling cupcakes, tech solutions, or handmade crafts, cost-based pricing gives you a solid foundation.

So, take the time to assess your costs, keep an eye on the market, and embrace tools that make pricing easier. With a little effort and attention, you’ll be setting prices that work for you and your customers alike.

Now it’s your turn—are you ready to try cost-based pricing for your business? Let’s make 2025 the year of smart, sustainable growth!